Personal Loans That Pull Transunion Only 2026 Storage All Files Free Link

Launch Now personal loans that pull transunion only select broadcast. 100% on us on our media destination. Plunge into in a great variety of binge-worthy series highlighted in premium quality, tailor-made for exclusive watching admirers. With content updated daily, you’ll always receive updates. Discover personal loans that pull transunion only recommended streaming in sharp visuals for a truly enthralling experience. Enroll in our digital space today to see exclusive premium content with no payment needed, access without subscription. Get access to new content all the time and investigate a universe of specialized creator content designed for prime media buffs. Seize the opportunity for distinctive content—download quickly! Experience the best of personal loans that pull transunion only unique creator videos with brilliant quality and exclusive picks.

Upgrade is one such lender, and it stands out for its high loan amounts (up to $50,000) with reasonable interest rates. Compare secured personal loan options from multiple lenders. They offer personal loans from $1,000 to $40,000 for debt consolidation, major purchases, and more

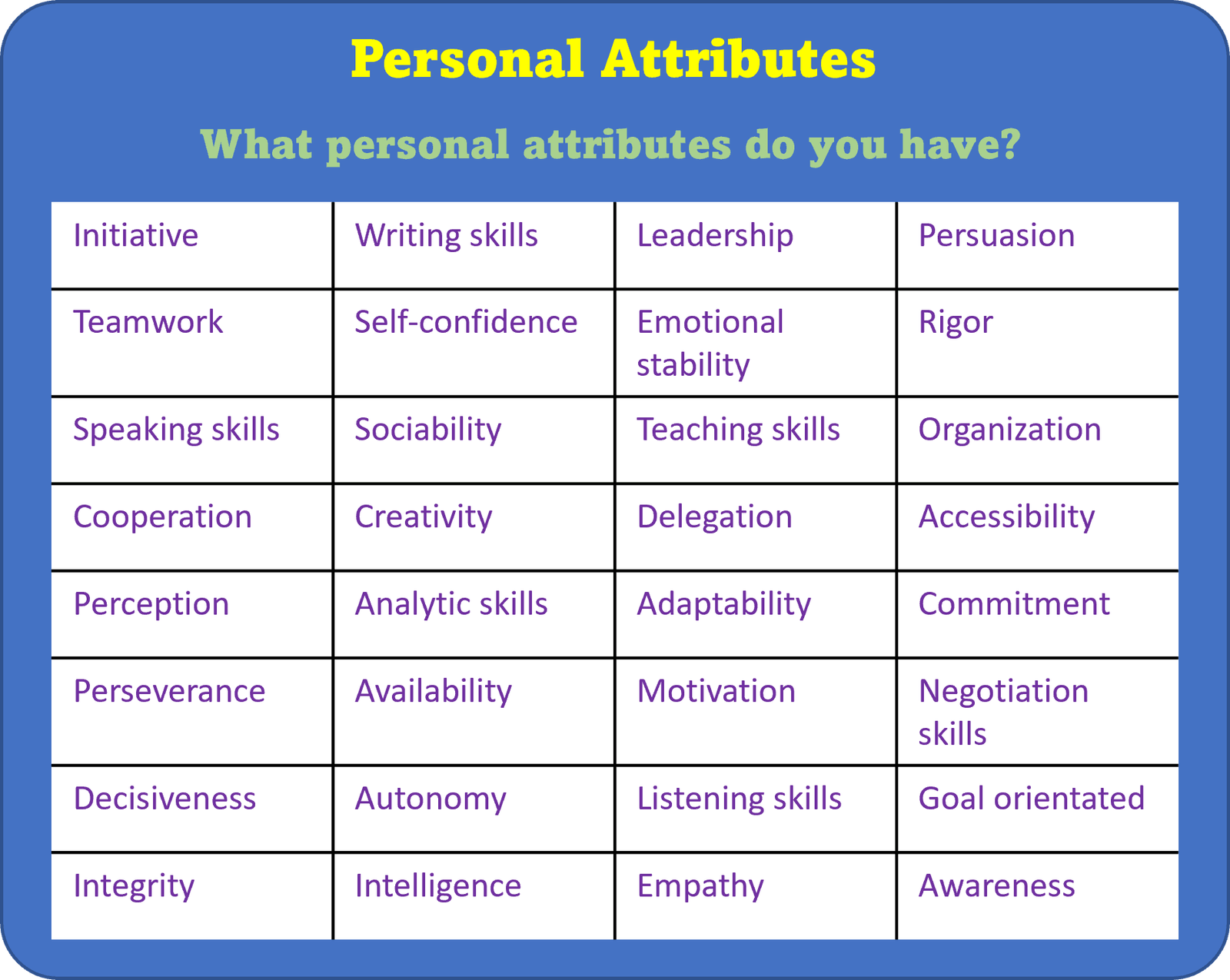

What Are Your Personal Values?

Lendingclub conducts a soft pull initially and only checks transunion when you formally apply. Secured personal loans let you borrow money against the value of an asset like a car or savings I got approved for $40k with a soft pull, and no docs

#sofi #personalloan #personalloans best unsecured personal loans for people with bad credit in the usa in 2025

The role of transunion in lending decisions lenders use transunion credit reports to assess a borrower’s creditworthiness Some credit cards from major issuers like chase, citi, and capital one primarily pull transunion reports for approval decisions However, issuer policies can change, so it’s best to confirm directly with the issuer Credit reporting and lender preferences when it comes.

It sounds like there's something on the experian report that isn't on the equifax or transunion Lenders usually pull all three and average If you have cash that is the better option in the current market If you don't have cash yes, you can do a downpayment+loan but you'll probably want to try and make extra payments to principle in order to reduce how much you pay in interest.