Loans That Use Transunion Only 2026 Archive HD Media Free Link

Enter Now loans that use transunion only VIP video streaming. Subscription-free on our cinema hub. Experience fully in a large database of themed playlists featured in best resolution, suited for discerning streaming mavens. With new releases, you’ll always stay updated. Discover loans that use transunion only preferred streaming in breathtaking quality for a absolutely mesmerizing adventure. Participate in our online theater today to browse solely available premium media with with zero cost, no sign-up needed. Enjoy regular updates and delve into an ocean of rare creative works produced for exclusive media addicts. Take this opportunity to view original media—download fast now! Treat yourself to the best of loans that use transunion only singular artist creations with breathtaking visuals and exclusive picks.

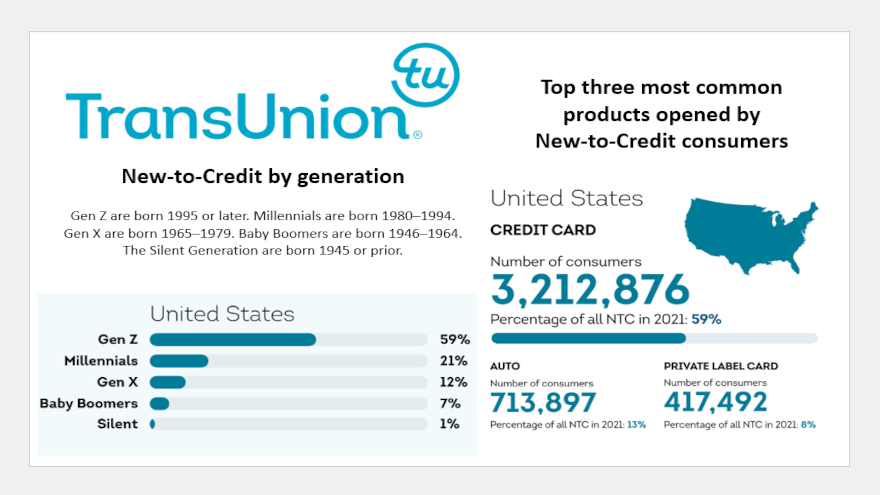

There are some loan companies that use transunion only for credit checks Many car finance companies use transunion, like ford motor credit company with an average credit score of 653 to 855, carmax auto finance with 355 to 855, and toyota. If your strongest credit report is held by transunion and you want to increase your approval odds, you may want to apply for a loan from one of the companies listed below

With End of Student Loan Forbearance for 27M Consumers: TransUnion

Be aware that even if a lender only pulls from transunion, it may still have strict credit requirements for approval Which car finance companies use transunion If transunion shows your strongest credit report, applying with a lender that only checks transunion can help increase your odds of getting approved

In this comprehensive guide, we'll cover everything you need to know about auto loan companies that use transunion only.

Any auto lenders that only use transunion Hey guys, does anyone know what lenders use just transunion for auto loans Redstone fcu 5k, us bank 11k, suncoast cu 5k, cap one plat $450, cap one quicksilver $900, nfcu 8k, firestone 1.2k, ascend fcu 9.5k Guaranteed rate is a mortgage lender that uses transunion reports, along with reports from the other major credit bureaus

Guaranteed rate has a strong online presence and provides tools to help borrowers navigate the mortgage. The role of transunion in lending decisions lenders use transunion credit reports to assess a borrower's creditworthiness Some credit cards from major issuers like chase, citi, and capital one primarily pull transunion reports for approval decisions However, issuer policies can change, so it's best to confirm directly with the issuer

Credit reporting and lender preferences when it comes.

Loans that pull transunion credit reports through research, i've identified several top lenders for personal loans that only check transunion credit reports They offer personal loans from $1,000 to $40,000 for debt consolidation, major purchases. Learn how to apply for a personal loan in 6 steps This guide can help you navigate the process from accessing your financial needs to managing repayments.

It sounds like there's something on the experian report that isn't on the equifax or transunion Lenders usually pull all three and average If you have cash that is the better option in the current market If you don't have cash yes, you can do a downpayment+loan but you'll probably want to try and make extra payments to principle in order to reduce how much you pay in interest.

The bureau establishes a trustworthy bond between the lender and borrower